Industry News

Markets

News

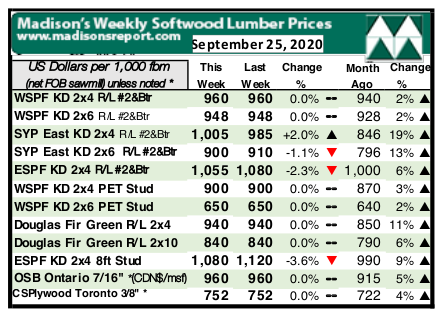

Most softwood lumber prices remain level while eastern items correct down

September 29, 2020 By Madison’s Lumber Reporter

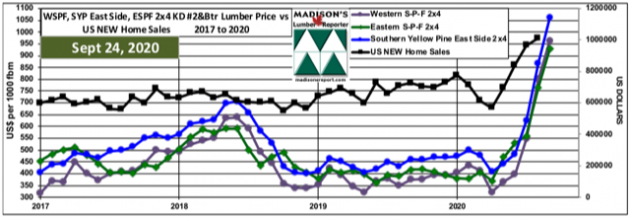

There was more confusion in the North American construction framing dimension softwood lumber market last week as prices of most home building solid wood commodity items stayed flat, except Eastern S-P-F which did correct down somewhat. The supply-demand balance seemed to be finding an even keel, although customers still were reluctant to make big purchases at unprecedented highs. The latest U.S. data for housing starts, home sales, and house prices all show phenomenal increases, indicating very strong demand for real construction and remodeling projects could keep prices up for a while yet.

Privately-owned U.S. housing starts in August were at a seasonally adjusted annual rate of 1,416,000, the U.S. Commerce Department said September 17. This is -5 per cent below the revised July estimate of 1,492,000, but is +3 per cent above the August 2019 rate of 1,377,000. Total starts were up +3 per cent year-over-year compared to August 2019. The dip in housing starts was driven by a -25 per cent decline in multifamily construction activity. Single-family housing starts in August were at a rate of 1,021,000; this is +4 per cent above the revised July figure of 981,000. Single family starts were up +12 per cent year-over-year.

Elsewhere, the U.S. Commerce Department said Thursday new home sales rose +5 per cent to a seasonally adjusted annual rate of 1.011 million units last month, the highest level since September 2006. New home sales are counted at the signing of a contract, making them a leading housing market indicator. New home sales are up +43.2 per cent from August 2019. There were 282,000 new homes on the market in the U.S. last month, down from 291,000 in July. At August’s sales pace it would take 3.3 months to clear the supply of houses on the market, down from 3.6 months in July. About 71 per cent of the homes sold last month were either under construction or yet to be built. “The August figure is the first reading above 1 million since 2006, so both new and existing home sales registered their best results since 2006 in August,” said Amherst Pierpont Chief Economist Stephen Stanley

“Eastern Canadian lumber and stud producers reported slower sales activity last week as buyers who would have pounced on loads a couple weeks ago began to vacillate and throw out counter offers. Sawmill order files were around three weeks out with very limited material available any earlier.” — Madison’s Lumber Reporter

Advertisement

Sales volumes of Western S-P-F lumber and studs in the United States took another step back last week. Buyers were increasingly cautious as the disparity between November lumber futures and the current cash market reduced overall urgency to buy. Sawmills held on to order files into at least late October and kept their prices flat. Lack of supply was a constant topic of discussion and field inventories remained nearly empty in most cases.

Western S-P-F sales activity in Canada remained quiet last week as buyers were content to wait for previously-ordered wood to arrive while they filled their inventory gaps opportunistically from the distribution level. Producers maintained five week order files at sawmills and were unworried about the pause in demand, as they were keenly aware of the depleted state of all downstream field inventories. Rail car supply was still an issue, which predictably put increasing pressure on truck availability.

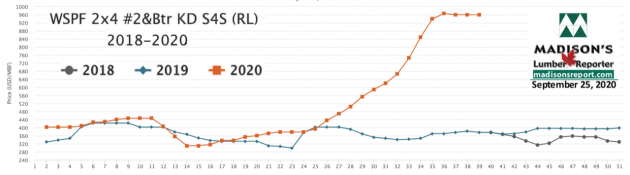

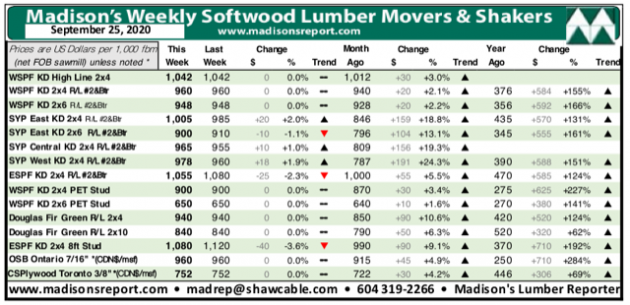

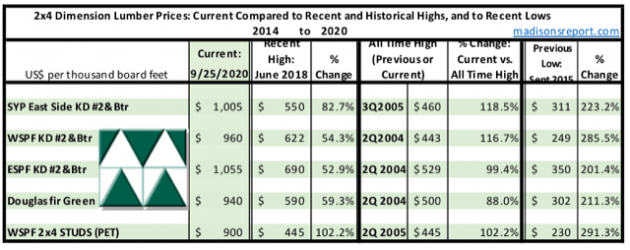

For the week ending September 25, 2020 the price of benchmark softwood lumber commodity item Western S-P-F KD 2×4 #2&Btr remained flat, as in recent weeks, at US$960 mfbm, said Madison’s Lumber Reporter. This price is +$20, or +2 per cent more than it was one month ago. Compared to mid-September 2019, this price is up a remarkable +$584, or +155 per cent.

“Dimension lumber prices were flat while panels (Plywood and OSB) seemed to have finally topped out. ” — Madison’s Lumber Reporter

Compared to one-year-ago, last week’s Western S-P-F KD 2×4 #2&Btr price was +$480, or +100 per cent, higher than the one-year rolling average price of US$480 mfbm and was up +$538, or +127 per cent, compared to the two-year rolling average price of US$422 mfbm.

The below table is a comparison of recent highs, in June 2018, and current September 2020 benchmark dimension Softwood Lumber 2×4 prices compared to historical highs of 2004/05 and compared to recent lows of Sept 2015:

Print this page