Industry News

Markets

News

Normal seasonal slowdown brings flat lumber prices: Madison’s

July 12, 2022 By Madison’s Lumber Reporter

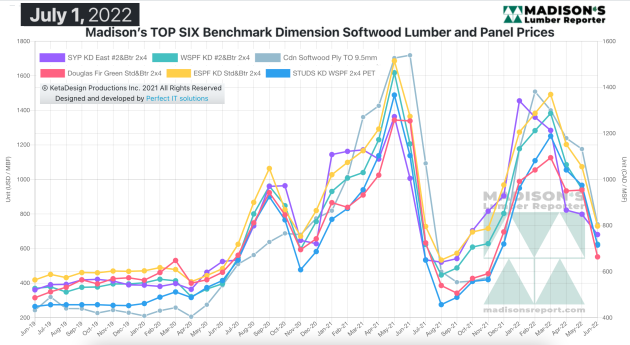

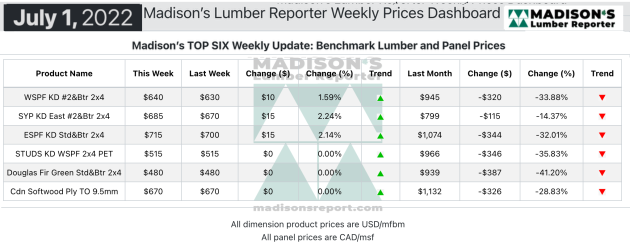

As the dual Canada Day/U.S. Independence Day long weekend arrived, most softwood lumber and panel prices stayed relatively flat compared to the previous week. This is the time of year when lumber demand starts to drop and prices either fall or remain flat.

The large-volume buyers — the big U.S. home builders — have made their purchases and received their wood for planned construction projects to autumn. Across North America sawmills choose this time to take seasonal and maintenance curtailments and downtime.

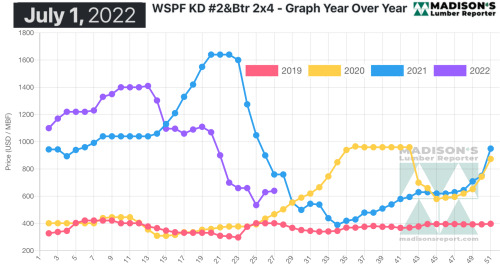

Popping up slightly from the previous week, for the week ending July 1, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$640 mfbm. This is up by US$10, or two per cent from the previous week when it was US$630 and is down by US$15, or two per cent, from one month ago when it was US$625.

Sawmills were firm on most of their asking prices while extending order files into the weeks of July 11th and 18th.

“As the double national holiday weekend approached, demand for North American lumber seemed to firm up across the board.” — Madison’s Lumber Reporter

The national holidays of Canada Day and Independence Day set the stage for strong sales. Western S-P-F buyers in the U.S. worked to cover at least their immediate needs if not more. Primary and secondary suppliers alike were notably busy until around midweek, at which point many customers had covered the essentials and shifted their focus to some relaxing time off.

As players on both sides of the border prepared to enjoy national holiday celebrations, purveyors of Western S-P-F lumber in Canada reported solid demand and takeaway overall. Sales petered out near the end of the week as everyone took off work early, but business up to Thursday was mighty encouraging.

“Solid demand and follow-through were evident in the Eastern S-P-F market as commodity prices settled into an apparent trading range. Determined customers were able to source enough material to plug holes in their inventories, but that required plenty of calling around to both primary and secondary suppliers. By midweek several producers were off the market on a number of items, further reducing the options available to buyers.” — Madison’s Lumber Reporter

Print this page