Industry News

Markets

Softwood lumber prices rebound as construction material buying season gets going

February 5, 2019 By Madison's Lumber Reporter

North American construction framing dimension softwood lumber prices shot up spectacularly last week as lean field inventories forced customers to come to the table for large-volume buys.

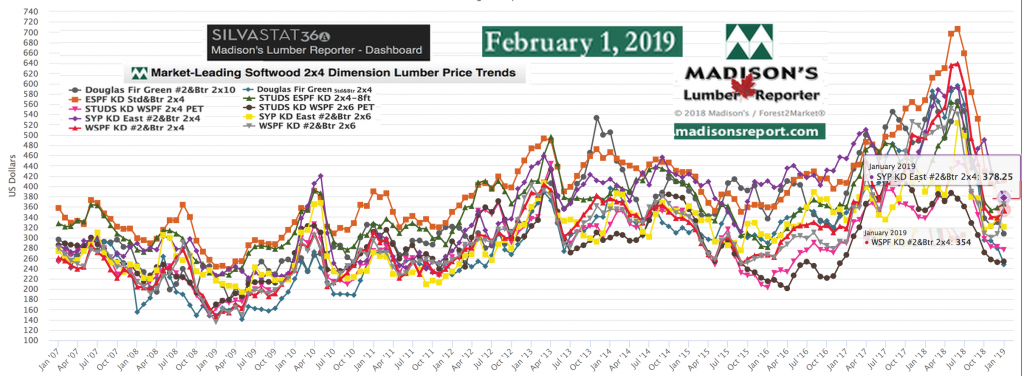

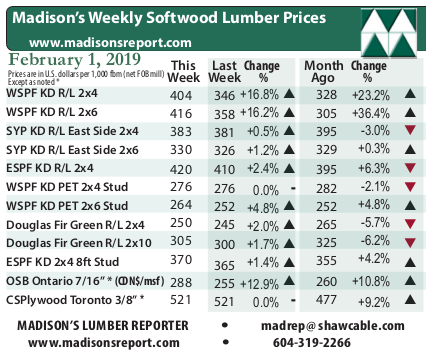

Immediately at the beginning of January, wholesaler prices of benchmark lumber commodity Western Spruce-Pine-Fir KD 2×4 #2&Btr started rising off full-year 2018 lows, finishing last week at US$404 mfbm, a $58 or +14.4% increase from $346 the week before. At close Monday, lumber futures on the Chicago Mercantile Exchange were US$423, a historically-appropriate $25 premium to cash prices.

Canadian and U.S. softwood lumber prices strengthened considerably as end-users found themselves low on inventory for a wide range of products. Sawmills booked production out to four weeks or longer, while secondary suppliers worked to both replenish inventories from last week’s buys and book more sales going forward.

WSPF prices jumped significantly while customers’ depleted inventories ensured their reluctant continued buying. — Madison’s Lumber Reporter

Advertisement

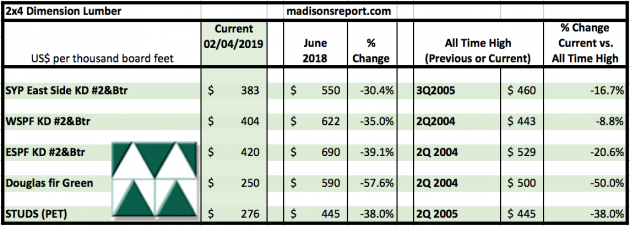

Current Softwood Lumber Prices Compared to Recent and Historical Highs: Feb 2019

This week’s Southern Yellow Pine East Side 2×4 #2&Btr KD, the other large volume-traded softwood lumber commodity, composite price was US$389 mfbm, a +0.8% decrease from the previous week’s price of $392, and a -13.6% decrease from the same week in 2018. Year-To-Date average price from Forest2Market’s Southern Yellow Pine index is US$382 mfbm.

As for panel, Oriented Strand Board 7/16” Ontario vaulted $33, or +11.5%, to C$288 msf from last week’s $255. For it’s part, Canadian Softwood Plywood 9.5mm Toronto stayed flat at C$521 msf.

Wild winter weather hit most of the continent, but isn’t expected to effect overall seasonal lumber production or construction projects. Most players expect shipment delays and problems with the railroads, as that usually happens when severe weather hits.

Demand for Kiln-Dried Douglas-fir commodities continued to ratchet up inexorably as mild weather in many target markets – particularly those in the West – helped keep construction sites active. — Madison’s Lumber Reporter

The below table is a comparison of June 2018 and January 2019 benchmark dimension softwood lumber 2×4 prices compared to historical highs of 2004/05:

Find the latest pricing information from Madison’s Lumber Reporter at www.madisonsreport.com.

Print this page