April 25, 2024

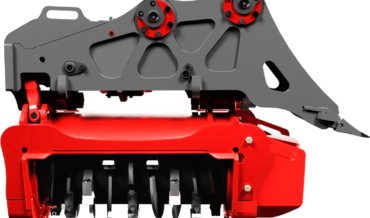

Tried and true practices: Leveraging tech investments

April 17, 2024

Attention contractors: Join the conversation

April 15, 2024

First Nations take the lead

April 4, 2024

Elevating safety leadership

April 27, 2024

Nova Scotia and Finland boost forest sector collaborationApril 23, 2024

Stagnant lumber market keeps prices flat: Madison’sApril 22, 2024

West Fraser completes sale of two pulp mills

Advertisement

Stories continue below

-

March 26, 2024

Saskatchewan invests $248,000 toward women in trades

-

March 8, 2024

International Women’s Day: Cultivating change

-

March 7, 2024

Rooted ambitions: Q&A with Ritikaa Gupta

-

April 17, 2024

Attention contractors: Join the conversation

-

January 4, 2024

Succession for your business

-

January 21, 2021

Complete 2020 CFI Contractor Survey now available

-

December 18, 2020

2020 Contractor Survey: Regional View – Atlantic Canada