Industry News

Markets

North America construction framing dimension softwood lumber prices firm over 2019-end

January 14, 2020 By Madison's Lumber Reporter

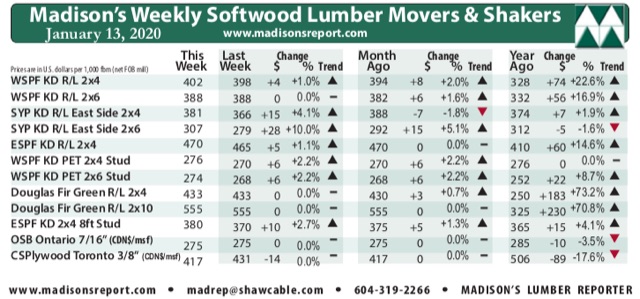

As expected by most softwood lumber players at the end of last year, the generally buoyant demand for construction framing dimension lumber products at the end of 2019 carried through to somewhat strengthening prices in the first week back to work for sawmills across Canada and the U.S. in 2020. The latest round of sawmill closures, mostly in British Columbia, and continually improving demand for home buying in the U.S. are working to keep lumber supplies quite tight with demand. This past week, North American sawmills reported to Madison’s Lumber Reporter that their order files were longer than one-week, which is quite good for this normally slow time of year.

Some issues of lumber supply crunch which were becoming apparent into the end of 2019 remain stubbornly in place. Those who chose to avoid buying any more wood than absolutely necessary, in faint hopes that prices might drop, were not pleased to find that most prices a the start of 2020 were actually up from the end of last year. Yet they still had to buy, so depleted were their inventories just for immediate needs. Spring is still a way away in most busy construction markets; however, unseasonably mild weather last week had builders quite busy. Thus they did need to stock up on more wood, so manufacturers were able to nudge many prices up.

Lumber demand and purchasing kept up nicely with the pace of production, as sawmill order files for western Canadian sawmills ranged from one to three weeks out. — Madison’s Lumber Reporter

Advertisement

Major lumber stocking wholesalers in the U.S. Northeast were mostly positive about the potential for business in 2020. The timing of Christmas 2019 in the middle of the week killed demand momentum during the holidays. Weather in the U.S. northeast was actually decent for January and there was plenty of construction work ongoing to consume framing lumber, studs, and panels. But vendors know to be cautious with any burgeoning optimism during winter.

Be ahead of these data releases … Don’t delay, this week’s softwood lumber market comment was published to the website Monday morning.

* Madison’s Lumber Prices, weekly, are a good forecast indicator of U.S. home builder’s current lumber buying activity

For their part, producers of kiln-dried Douglas fir had little to complain about as they extended most of their sawmill order files into the week of Jan. 27. Product availability for Jan. 20 dwindled by the day. — Madison’s Lumber Reporter

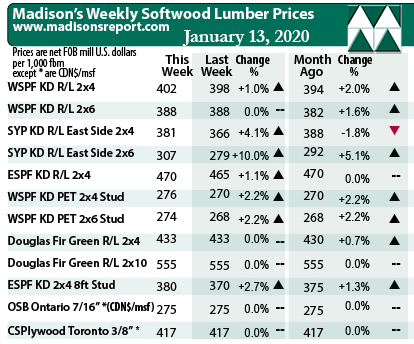

Compared to historical trends, last week’s WSPF 2×4 #2&Btr price continued rising, up by another +$4, or +1%, relative to the previous week’s price of U.S. $398 mfbm, and is up +$74, or +23%, relative to the same week one year ago. This is a big reversal over the same time last year, when this benchmark lumber commodity item price was down significantly. And dropping.

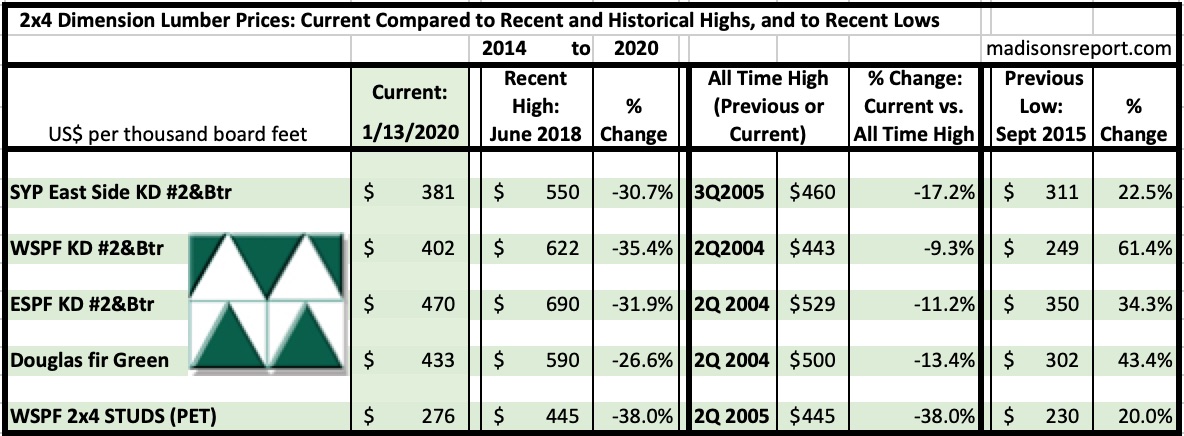

The below table is a comparison of recent highs, in June 2018, and current Jan. 2020 benchmark dimension softwood lumber 2×4 prices compared to historical highs of 2004/05 and compared to recent lows of Sept. 2015:

Print this page