Industry News

Markets

Softwood lumber prices soften, US housing starts pop: March 2019

March 12, 2019 By Madison's Lumber Reporter

Important data releases delayed by the U.S. government furlough are starting to catch up to normal schedule. Because everything is related between agencies, there have been delays in Statistics Canada releases, since StatsCan works closely with U.S. Census on North America data. This week Monday came out Canadian sawmill manufacturing sales and Canadian softwood lumber production, as well as U.S. housing starts for January.

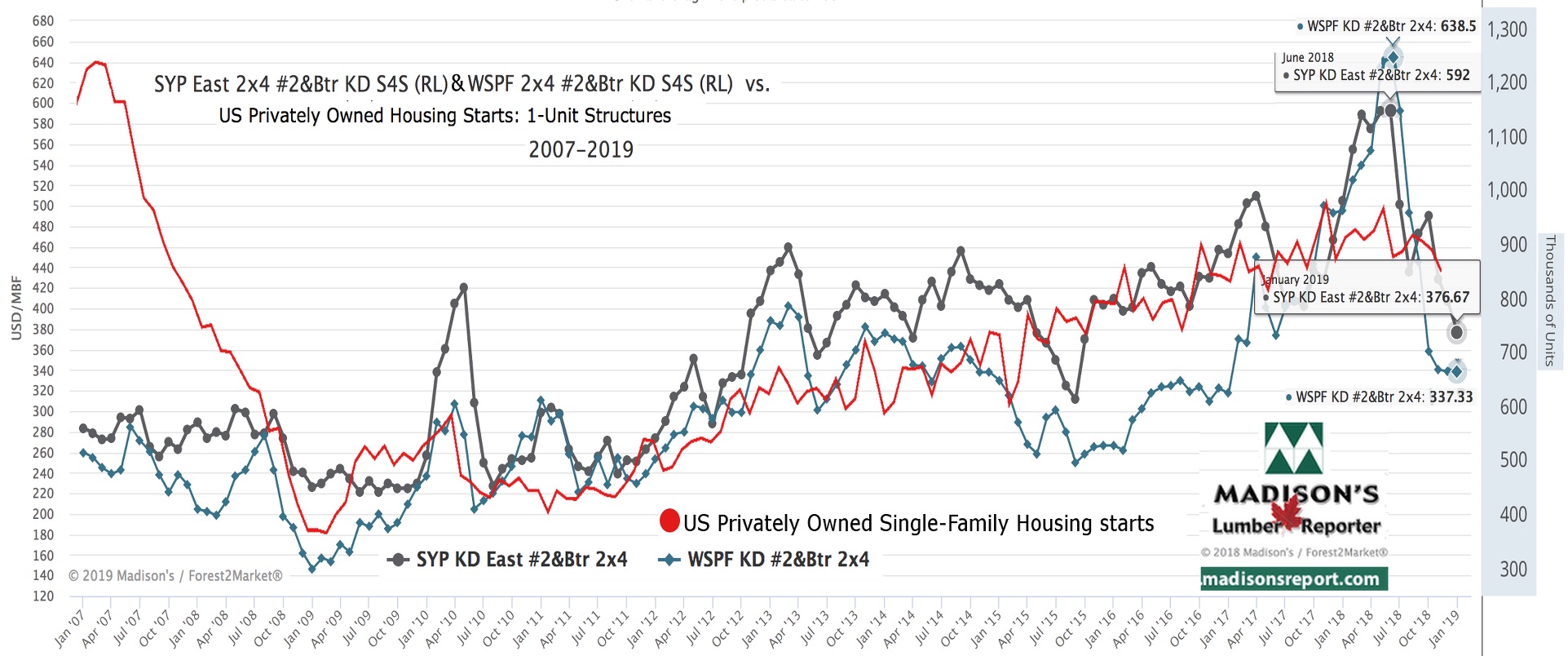

When this data is put against North America lumber prices there is apparent a very good metric and indicator for near-term future U.S. home building activity. Please see full-year 2018 Canadian sawmill sales and lumber production here.

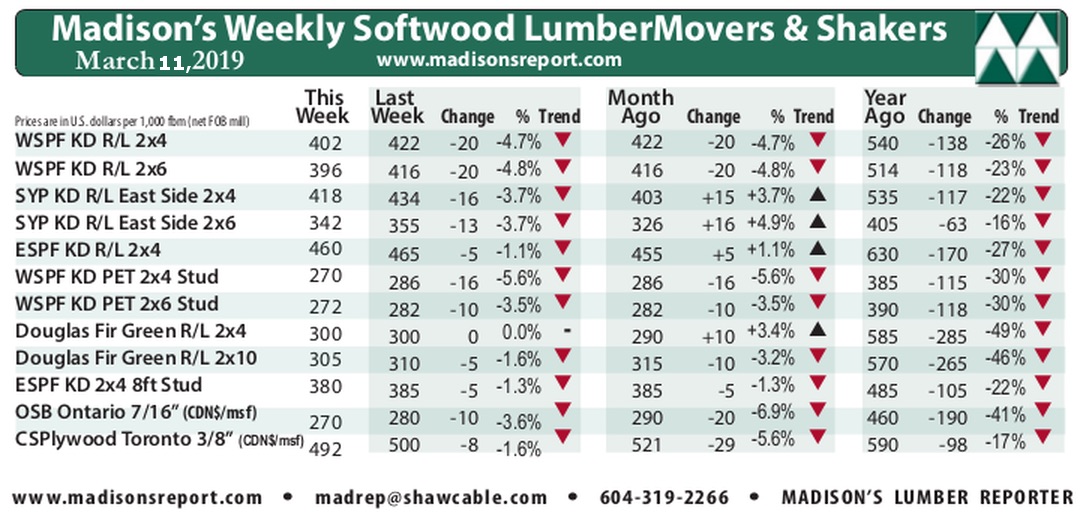

After remaining flat at U.S.$422 mfbm for several weeks, wholesaler prices for benchmark lumber (net FOB sawmill) commodity Western Spruce-Pine-Fir KD 2×4 #2&Btr dropped by -$20, or -5%, to end last week at U.S.$402 mfbm. The prices of most other standard commodities were unchanged from the previous week, however studs took a beating, with big dips of -1% to -6% across all species of studs. One-year-ago, that price was $138, or 34%, higher than it is now; at U.S.$540 mfbm in the beginning of March 2018.

This could provide insight into future U.S. 2-to-4 unit new construction, as more studs are used here than for single-family building.

A troubling development last week, as Madison’s reported, “The U.S. Lumber Coalition made moves last week to revise current 20 per cent duties on softwood lumber imports from Canada. While the revision would normally be a routine request under the umbrella of annual administrative reviews, the more than 1,000 Canadian producers and exporters being targeted for revision of countervailing duty rates is out of the ordinary. Following the typical 12 to 18 month period for administrative reviews, Canadian companies can expect possible revisions of rates on future imports, as well as potential retroactive adjustments to duties deposited during the periods under review by the U.S. Department of Commerce.”

More news on this surfaced Tuesday as an Ontario hardwood sawmill contacted Madison’s with their “administrative notice.” Details on this will be provided as soon as it occurs.

Sales activity for WSPF mills in the United States improved noticeably last week as producers reduced most of their #2&Btr R/L asking prices. — Madison’s Lumber Reporter

The latest U.S. housing starts data, for January 2019, has proved quite positive. U.S. residential housing starts in January rose +18.6% to a 1.23 million annualized rate, according to U.S. Commerce Department figures Monday that were delayed two weeks by the federal shutdown. Permits, a proxy for future construction, rose 1.4 percent to a 1.35 million rate, compared with forecasts for a decline.

In even better news for the forest products industry, most of this new construction came from single-family houses, which were being built at the strongest rate since May 2018.

Overall U.S. housing starts in January were slightly below the 2018 total of 1.24 million as the pace of apartment construction slowed.

This week’s price for the other large volume-traded softwood lumber commodity, Southern Yellow Pine, more than reversed increases in previous weeks, falling -$16, or -4%, to U.S.$418 mfbm, from $434 the week before. One-year-ago, that price was $117, or 28%, higher than it is now; at U.S.$535 mfbm in the beginning of March 2018.

Purchase inquiry and sales follow-through from U.S. markets increased palpably last week according to WSPF mills in Canada. — Madison’s Lumber Reporter

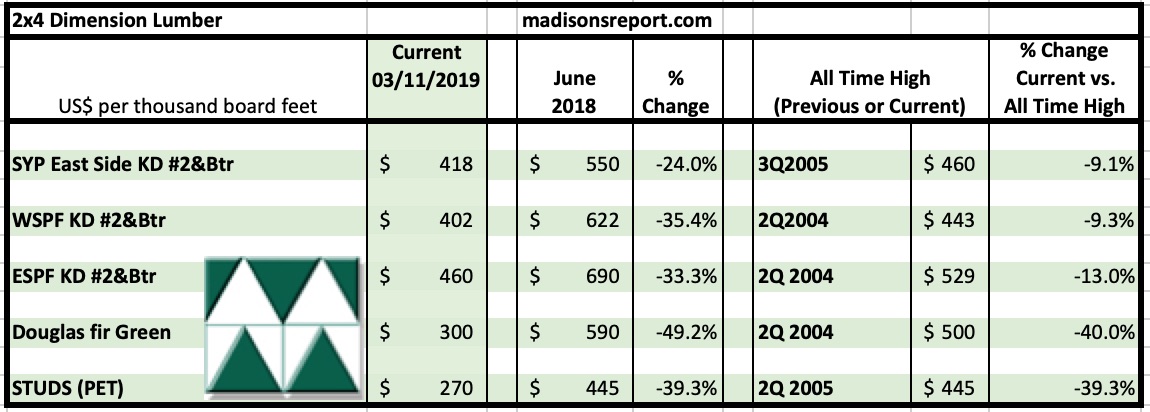

Current softwood lumber prices compared to recent and historical highs: March 2019

The below table is a comparison of June 2018 and March 2019 benchmark dimension softwood lumber 2×4 prices compared to historical highs of 2004/05:

Print this page